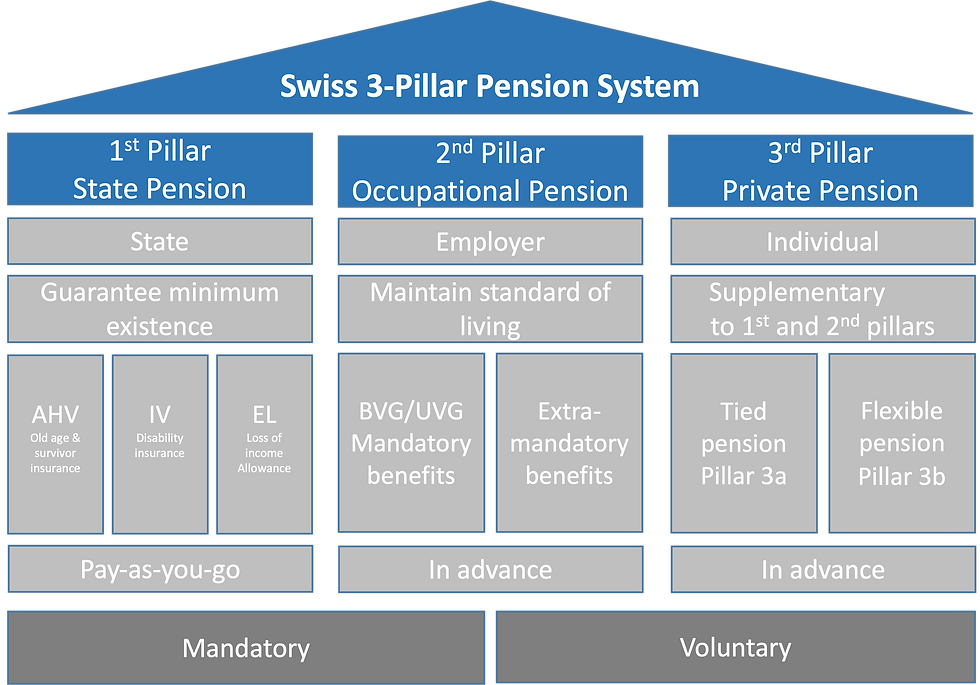

Understanding the 3 pillars

The 1st Pillar - Safeguard your existence

The Old Age & Survivor Insurance (OASI) pension guarantees a secure existence which means that only the bare minimum costs of living are covered.

How much do you have to pay and when?

Employees begin to pay mandatory OASI contributions on 1st January after reaching the age of 17 and end when they reach retirement age (64 for women, 65 for men).

Total of contributions is 10.6% of the gross salary

8.7% - OASI

1.4% - Disability Insurance

0.5% - Loss of income

Employer and employee each pay half of the contributions. The employer has to pay the contributions to the Swiss Compensation Office.

OASI contributions and “Skala 44”

The relevant scale for full pensions is called “Skala 44” and stipulates 44 years of payment contributions.

Individuals paying in an annual average of CHF 86’040 for 44 years receive a full pension.

Those having fewer contribution years receive a proportionally lower pension.

For each missing contribution year, the pension is usually reduced by 1/44th.

Missing contribution years can be compensated by youth years and/or one-time payments.

Youth years are the years worked between the ages of 17 and 19 typically after the apprenticeship.

For one-time payments, payment has to be made within 5 years of the missing contribution year. The minimum contribution p.a. is CHF 503.-

When and how much pension will you receive?

After the normal age of retirement (64 for women, 65 for men), every insured person receives a monthly pension from the OASI. The amount of the pension depends on the amount of contributions paid and the length in years of the contributions.

For the full contribution period (as of 2021):

Individuals - Maximum monthly pension is CHF 2’390.- and minimum is CHF 1’195.-

Married couple (Two pensions combined) - Maximum monthly pension is CHF 3’585.-

For contributions of less than 44 years:

For each missing contribution year, the pension is usually reduced by 1/44th

E.g. 43 contribution years – Max. und min. monthly pensions are reduced by CHF 54.- resp. CHF 27.- for individuals

Early retirement

OASI pensions can also be paid out 1 or maximum 2 years before the official age of retirement. Pensions received earlier incur a lifelong reduction in benefit payments:

1 year earlier - Reduction of 6.8%

2 years earlier - Reduction of 13.6%

The 2nd Pillar - Safeguard the standard of living

Additional protection, that goes beyond the minimum required for a secure existence, is necessary to be able to continue the accustomed way of life.

The occupational Pension

The BVG (LPP) occupational pension is mandatory for all employees that are subject to OASI and have a permanent or fixed-term employment relationship that lasts longer than 3 months, with the condition that the gross annual salary exceeds CHF 21’510.

Insurance against the risks of death and disability runs from January 1st of the year in which an employee turns 18.

The process of saving for retirement begins on January 1st of the year in which an employee turns 25.

The 2nd pillar also includes compulsory accident insurance.

As with the AHV (OASI), the official age of retirement is currently 64 for women and 65 for men.

Insured annual salary - AHV & BVG (as of 2021)

The pension funds are obliged to insure annual salaries between the entry threshold of CHF 21’501 and CHF 86’040.

The benefits of the 1st and 2nd pillars are coordinated – the relevant income that has to be insured is known as the coordinated salary.

The 3rd Pillar - Private provision

The mandatory benefits from the 1st and 2nd pillars cover around 60% of previous income in old age, and only up to an income of CHF 86’040.- (as of 2021).

Due to the demographic development in Switzerland, in future fewer and fewer people will have to pay for the financing of retirement benefits for more and more pensioners.

Individual provisions made on a private basis, the so-called 3rd pillar, are therefore becoming increasingly important.

Private Provision - 3a

The 3a pillar is tied to retirement and annual investments can be deducted from taxes.

Employees can pay CHF 6883.- p.a. into a 3a pillar account and deduct the amount from the annual tax statement (as of 2021).

Self-employed can pay 20% of their salary up to max. CHF 34’416.- into a 3a pillar account and deduct the amount from the annual tax statement (as of 2021).

The 3a pillar is tied to retirement meaning once funds have been transferred to the 3a account, they are no longer readily available until 5 years before the age of retirement.

3a pillar accounts are available at the age of 59 for women and 60 for men (as of 2021).

Under the following circumstances an earlier pay out is possible:

Death or invalidity

Down payment for home ownership

Repayment of a mortgage (possible every 5 years and when the mortgage refinancing is due)

Leaving Switzerland

Starting Self-employment

3a pillar account pay outs can also be deferred for 5 years i.e. until 69 for women and 70 for men.

Tax is due on the lump sum pay outs but is taxed separately from other income and according to special methods.

Private Provision - 3b

The 3b pillar is NOT tied to retirement and can be used for mid- to long-term savings goals. This can include investments in stocks, securities, real-estate or even vintage cars.

Comments